Budget 2025: A Step Towards a Viksit Bharat? – Initial Reactions from Accovet

Budget 2025 represents a strategic roadmap for India’s continued economic development, balancing near-term imperatives with the long-term vision of a ‘Viksit Bharat’, as seen from Accovet’s perspective. This budget, in our view, signals a continued commitment to the strategies that have propelled India’s growth in recent years, even amidst global economic uncertainties. We at Accovet see the emphasis on ‘Sabka Vikas’ – inclusive development – as central to unlocking India’s full potential. The focus areas outlined, ranging from agricultural revitalization and rural empowerment to boosting manufacturing and promoting innovation, align with our understanding of the key drivers of a thriving economy. Accovet believes that the proposed reforms across critical sectors like taxation, power, and urban development, if implemented effectively, can be transformative. This budget, in our analysis, underscores the government’s resolve to leverage the combined power of agriculture, MSMEs, investment, and exports, supported by ongoing reforms, to achieve the ambitious goals of a developed India. We at Accovet will be closely examining the specific measures and their potential impact on various sectors in the coming days.

From Accovet’s perspective, Budget 2025 introduces several key measures with significant implications for the business landscape and individual taxpayers. A notable focus is the simplification and streamlining of regulatory processes. The simplification of KYC procedures by the central KYC System are positive steps towards enhancing ease of compliance.The introduction of dedicated credit cards for micro-enterprises, coupled with measures facilitating company mergers, underscores the government’s commitment to strengthening the MSME sector, a critical engine of economic growth. Personal income-tax reforms, particularly those targeted at the middle class, have the potential to stimulate consumption and drive demand. The proposed scheme for first-time entrepreneurs, along with the extension of the Section 80-IAC time limit for startups, signals continued support for innovation and the creation of new ventures. Furthermore, the rationalization of TDS and TCS rates, coupled with the simplification of tax provisions for charitable trusts and institutions, promises a more transparent and efficient tax environment.The extension of timelines for filing updated returns and the introduction of the Jan Vishwas Bill 2.0 and initiatives aimed at promoting medical tourism and the “Heal in India” brand reflect the government’s focus on improving governance and bolstering key service sectors. Accovet will conduct a thorough analysis of these measures to assess their comprehensive impact on various stakeholders.

Highlights & Analysis

KYC Simplification & Central KYC: Streamlining Compliance

As per the budget speech Government is proposing to implement the earlier announcement on simplifying the KYC process, the revamped Central KYC Registry will be rolled out in 2025. The government will also implement a streamlined system for periodic updating. A Central KYC system is crucial for efficient compliance. It reduces burdens on businesses and individuals, minimizes errors and duplication. Accovet has long advocated for improvements to the KYC system, highlighting existing challenges and we are pleased to note that the budget acknowledges the need for reform. The move towards a Central KYC system, a key recommendation from Accovet to the Ministry of Corporate Affairs, is a direct result of concerns and suggestions we have reported. We believe this centralized approach, combined with the simplification of KYC procedures, will significantly reduce the errors and duplication. While further details are awaited, this development aligns with our vision for a more streamlined and effective KYC framework.

Rationalization of Merger of Companies

The Finance Minister announced that the requirements and procedures for speedy approval of company mergers will be rationalized. She further stated that the scope for fast-track mergers will be expanded, and the overall process will be simplified to enhance efficiency. We believe that these measures are highly urgent to accelerate the ease of doing business.

Extending the time-limit to file the updated return

The Budget proposes to extend the time limit for filing updated returns from the existing 24 months to 48 months from the end of the relevant assessment year. As per the proposal, the additional tax payable will be 60% of the aggregate tax and interest for updated returns filed between 24 to 36 months, and 70% for those filed between 36 to 48 months, subject to certain conditions. In our view, this is a very positive move, providing taxpayers with greater flexibility while ensuring compliance.

Credit Cards for Micro Enterprises

The FM proposes to introduce customized Credit Cards with a RS 5 lakh limit for micro enterprises registered on the Udyam portal. In the first year, 10 lakh number such cards will be issued. These will boost the leverage and working capital of micro sector.

Scheme for First-time Entrepreneurs

The Budget announces the launch of a new scheme aimed at empowering 5 lakh women, Scheduled Castes, and Scheduled Tribes who are first-time entrepreneurs. Under this initiative, eligible beneficiaries will have access to term loans of up to Rs 2 crore over the next five years, enabling them to establish and expand their businesses. The scheme draws inspiration from the success of the Stand-Up India program and incorporates its key learnings to ensure effective implementation. Additionally, the initiative will include online capacity-building programs focused on entrepreneurship and managerial skills, equipping beneficiaries with the necessary knowledge and expertise to run successful enterprises. This move is expected to foster greater financial inclusion, promote self-reliance, and boost economic participation among underrepresented communities.

Simplification of tax provisions for charitable trusts/institutions

The Budget proposes to extend the validity period of registration for smaller trusts and institutions from the existing 5 years to 10 years, providing them with greater stability and reducing compliance burdens. Additionally, to ensure fairness in regulatory actions, the definition of specified violations for the cancellation of registration will be rationalized, ensuring that minor defaults, such as incomplete applications, do not lead to cancellation. Furthermore, the Budget aims to streamline the definition of persons making substantial contributions to trusts and institutions, refining the criteria for denial of exemptions. These measures are expected to promote a more transparent and efficient regulatory framework, ensuring that genuine charitable organizations can operate without undue hurdles while maintaining accountability.

Medical Tourism and Heal in India

Finance Minister Nirmala Sitharaman announced a strategic initiative to promote medical tourism and the ‘Heal in India’ program through partnerships with the private sector, capacity building, and streamlined visa norms. This initiative aims to leverage India’s advanced healthcare infrastructure and skilled medical professionals to attract international patients seeking high-quality and affordable medical treatments. The collaboration with private sector entities is expected to enhance service delivery and patient experience.These measures are anticipated to position India as a leading destination for medical tourism, contributing to economic growth and showcasing the country’s healthcare excellence on the global stage.

Extension of time limit for startups

The Government announced a significant extension of tax benefits under Section 80-IAC of the Income Tax Act, aiming to bolster India’s burgeoning startup ecosystem. The eligibility period for startups to avail of these benefits has been extended by five years, making the incentives available to startups incorporated before April 1, 2030. This move aligns with the government’s ongoing efforts to create a conducive environment for startups, following the abolition of the ‘angel tax’ in July 2024, which had previously posed challenges for early-stage companies and their investors.By extending the Section 80-IAC benefits, the government reaffirms its commitment to fostering a robust startup culture, driving economic growth, and positioning India as a global leader in innovation.

Rationalization tax deducted at source (TDS) and tax collected at source(TCS) rates

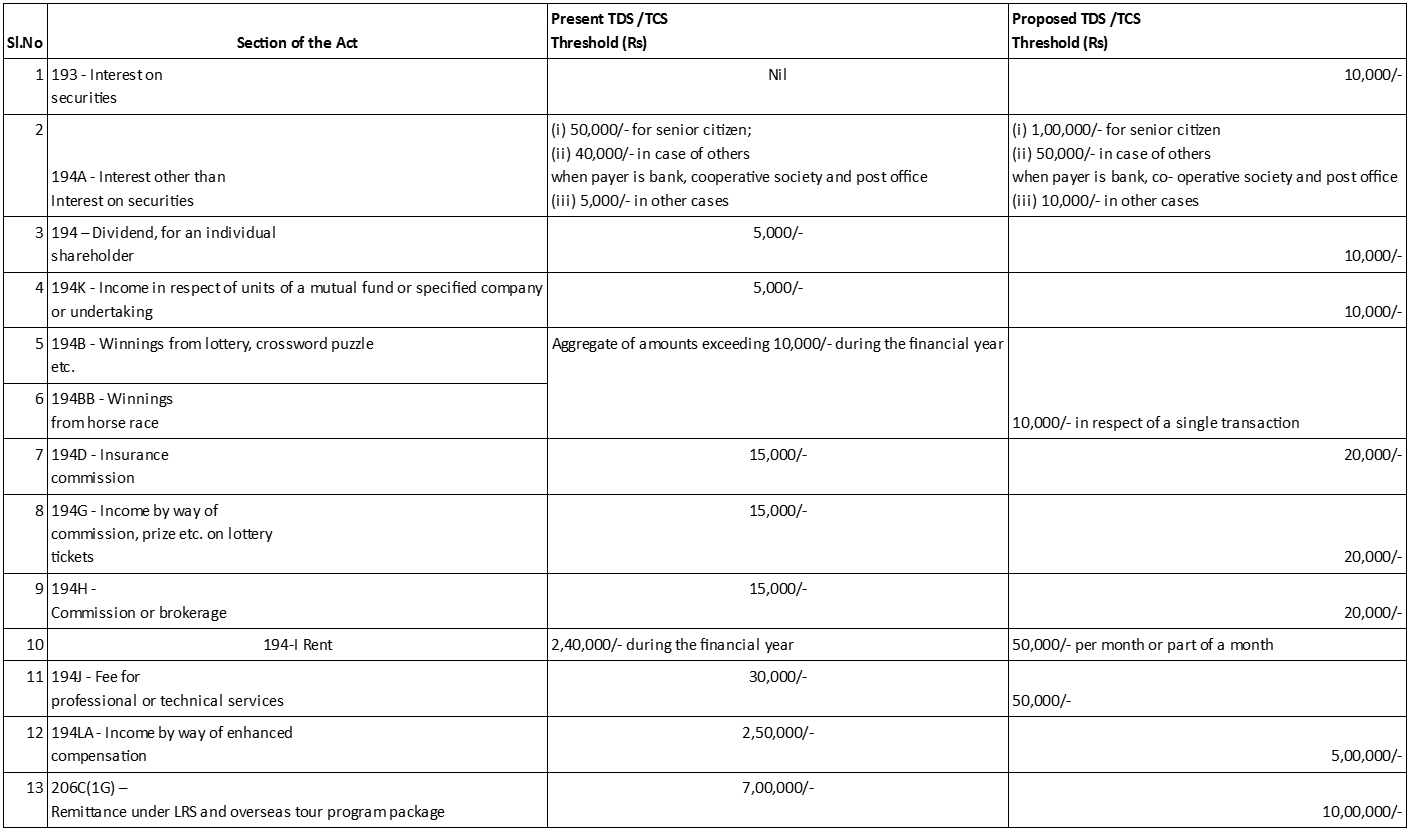

To reduce multiplicity of rates and compliance burden, the FM proposed to bring down certain TDS and TCS rates in certain sections with Key highlights of Rent from 2.4 Lakhs to 6 Lakhs, Professional Fee from 30,000 to 50,000 and Commission from 15,000 to 20,000. The proposed Rates are as below

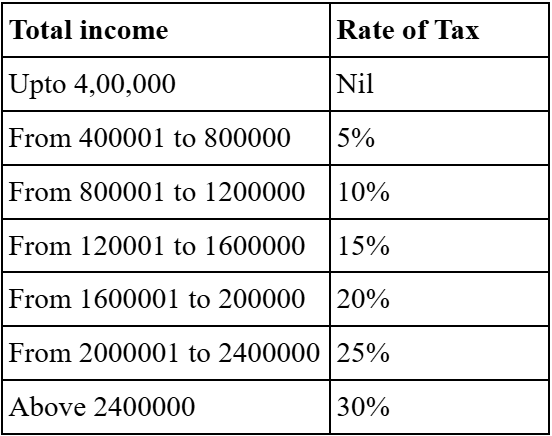

Personal Income-tax reforms with special focus on middle class

In the Budget 2025, Finance Minister Nirmala Sitharaman unveiled significant personal income tax reforms aimed at providing substantial relief to the middle class. The new tax regime introduces revised slabs and rates. A notable highlight is the increase in the rebate under the new tax regime, ensuring that resident individuals with a total income of up to Rs 12,00,000 will not pay any income tax. Resident individuals with total income up to Rs 7,00,000 do not pay any tax due to rebate under the new tax regime. It is proposed to increase the rebate for the resident individual under the new regime so that they do not pay tax if their total income is up to Rs 12,00,000.Marginal relief as provided earlier under the new tax regime is also applicable for income marginally higher than Rs 12,00,000.For salaried taxpayers, considering the standard deduction of Rs 75,000, this limit effectively rises to Rs 12,75,000. These reforms are designed to reduce the tax burden on the middle class, thereby increasing disposable income, stimulating household consumption, and fostering economic growth. By leaving more money in the hands of taxpayers, the government aims to boost savings and investments, contributing to a more robust and dynamic economy.

proposed the new tax regime with new slabs and tax ratesis as under:

The 2025 Budget’s personal income tax reforms reflect a strong commitment to supporting the middle class and driving economic expansion. The revised tax structure not only offers immediate financial relief but also sets the stage for sustained growth by empowering individuals to contribute more actively to the nation’s economy.