Employee’s Provident Fund (EPF)

Employees Provident Fund (EPF) is a scheme controlled by the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. It is a retirement benefit scheme that’s available to all salaried employees. This fund is maintained and regulated under the umbrella of Employee’s Provident Fund Organization (EPFO). Any company with over 20 employees is required by law to register with the EPFO.

Purpose of Provident Fund

The primary purpose of PF fund is to help employees save a fraction of their salary every month so that he can use the same in an event that the employee is temporarily or no longer fit to work or at retirement. Employers and employees both contribute @12% of wages in contribution accounts.

Who is Eligible for PF?

It is obligatory that employees’ drawing less than Rs 15,000 per month, to become members of the EPF. As per the guidelines in EPF, employee, whose ‘basic pay’ is more than Rs. 15,000 per month, at the time of joining, is not requried to make PF contributions. Nevertheless, an employee who is drawing a pay of more than Rs 15,000 can still become a member and make PF contributions, with the consent of the Employer and Assistant PF Commissioner.

Criteria for Registering For PF

If a company grows to the strength of minimum 20 members, then they need to register themselves within one month of obtaining the minimum employees. Irrespective of type of organization (except the exempt categories) be it proprietorship, partnership firm, LLP or company, etc., if the number of employees exceed 20 during any time of the financial year, registration with EPFO is mandatory.

Applicability of PF Registration

PF registration is mandatory for all establishments with 20 or more persons. Some establishments having less than 20 employees would also be required to obtain PF registration. All employee become eligible for a PF right from the commencement of employment and the onus of deduction & payment of PF is with the employer. The 12% rate of PF contribution should be equally divided between the employee and employer. If the establishment houses less than 20 employees, the rate for PF deduction is 10%.

Due Date for PF Filing with EPFO

The employer before paying the employees salary must deduct the employee’s contribution from his wages. Then the employee portion and employer portion are payable to the EPFO, within 15 days of the close of every month.

Documents Required or PF Registration

Based on the type of entity seeking PF registration, the list of documents required for PF registration would vary as under:

For Proprietorships

- Name of the applicant

- Pan card of proprietor

- Id proof of the proprietor like Driving license/Passport/Election Card

- Address proof of proprietor.

- Address proof for the premises.

- Complete details of the applicant with their residential address and telephone number

For Partnership Firms / LLP / Company

- Name of the partnership firm or LLP or Company

- Certificate of Registration Firms in case of Partnership firm. Incorporation Certificate in case of LLP or Company.

- Partnership deed in case of partnership firms or LLP.

- Id proof of Partners –Pan card /Election Card / Passport/Driving license in case of Partnership Firm or LLP. ID proof of Directors in case of company.

- List of all partners with telephone number and address proof of all partners in case of Partnership Firm or LLP. List of all Directors with contact details in case of Company.

Society/Trust

- In case of Society, Trust etc, Registration of the organization needs to be done with concerned authority.

- Certificate of Incorporation of Society/Trust.

- MOA and By Laws of society and trust.

- Id proof of president and all members of society

- Complete details of president and all members with their complete address and telephone number.

- Pan card of Society/Trust.

Common Documents Required for All Entities

- First sale bill.

- First purchase bill of raw material and machinery.

- GST REGISTRATION CERTIFICATE, if registered under GST.

- Name of the bankers, address of the bank.

- Record of a monthly strength of the number of employees.

- Register of salary and wages, all vouchers, all balance sheets from day one to current date of provisional coverage.

- Date of joining of employees, fathers name and date of birth.

- Salary and PF Statement.

- Cross cancelled cheque.

Steps for Epf Registration for Employers Through Online Application

Step 1- Register The Organization With EPFO

Visit the website and register the organization with EPFO. In the home page of the Unified portal, there is an option called “ESTABLISHMENT REGISTRATION”.

Step 2: Read the User Manual

Click on the “ESTABLISHMENT REGISTRATION” and it will take you to the next page where you will get an “INSTRUCTION MANUAL”. A new user must download and read the instruction manual completely before registration process.

Step 3: Register DSC

The employers who are already registered can login with their credentials i.e. with the Universal Account Number [UAN] and password. This instruction manual will explain the process of Employer Registration which is to be followed by registration of DSC [Digital Signature Certificate] of the Employer. Getting DSC registered is a pre-requisite to submitting a fresh application for ERF registration.

Step 4: Fill the Employer’s Details

Tick on “ I have read the instruction manual” completely. Click on “REGISTER BUTTON” given below. This will take you to the new page where all the employer’s details need to be filled in. The fields marked with the red star (asterisk) are mandatory to be filled in.

Step 5: Fill The Details Correctly

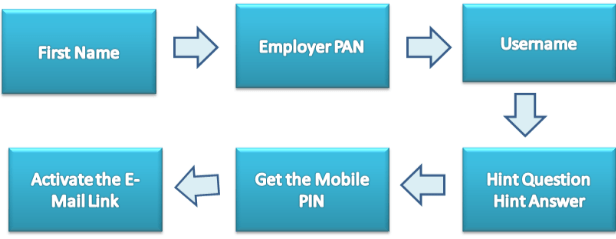

- First Name: The first name, middle name and last name should be entered exactly as furnished to the Income Tax Department. Any variance in the name of the Income Tax Department will lead to rejection as and when data is verified online.

- Employer PAN: After entering the employer’s PAN, a message will appear that shows employer is not registered previously. PAN will also be verified like name and an online application will be permitted.

- User Name: One can select the username of its choice. The system will automatically show whether the same username is available or not.

- Hint Question/ Answer: One can select the hint question and hint answer of its choice which will be helpful to the person in case one forgets the password. After filling up this, the registration process gets completely and you need to fill the CAPTCHA Code (Characters are shown in the image) then click on GET PIN button.

- Mobile PIN: The person will get the Pin number on the same mobile number with which you registered and then click on “I agree to the above declaration “

- Activate E-mail link: An e-mail link will be sent to the given e-mail id which is to be activated to enable the submission of an application for online registration of Establishment.

Conclusion

EPF is perhaps the easiest way to save money for the future without much hassle. Apart from the pension obtained from the Employee’s Pension Scheme, you also get insurance cover from EDLI. Your EPF account is automatically eligible for this cover and you do not have to contribute anything towards it. Furthermore, the EPFO invests 5 to 15% of its deposits in ETFs (Exchange Traded Funds). This way, you might get higher returns in future as the interest rates are likely to increase. Therefore, all these factors make EPF a safe retirement planning tool.