Concurrent Audit

It is the examination of financial transactions on a regular basis and it will be done in a systematic manner. The main objective of this type of audit is to ensure accuracy, authenticity, compliance with procedures and guidelines. Or else, we can say that, when the accounts are audited throughout the year by the audit staff under the guidance of the auditor, it is called a concurrent audit. This helps the management to timely know about the financial stability and also helps in maintaining the records in an order.

BENEFITS:

- Improve accuracy and timeliness of financial reporting especially at sub-district levels

- Reduces credit risk

- Ensure timeliness and accuracy of periodical financial statements and BOA

- Assess & improve overall internal control systems

- Regularly track, follow up and settle advances on a priority basis

- The books can be extensively checked and mistakes can be rectified

- Accounts can be finalized immediately after the end of the financial year

- Helps in declaration of bonus, dividend and in deciding about the new investments

APPLICABILITY:

- All branches which is rated as High Control Risk in the last Risk Based Internal Audit where serious deficiencies were found in Internal Audit.

- All specialized branches like Large Corporate, Mid Corporate, SME, Exceptionally large / Very large branches.

- Every Centralized Processing Units like Loan Processing Units, Service Branches, Centralized Account Opening Divisions, Central Pension Processing Centre etc.

- Every activities such as ATM, Credit and Debit Card Division, Cash Management Services, Digital Banking, Back office functions, Data Centres, Integrated Treasury/ branches handling Foreign Exchange business, Investment banking, etc.

- Bigger Overseas Branches, Corporate Communication, Terminal Benefits, Support Services, CP & MSME, Large Corporate Vertical etc.

- Any other branches or departments, if there is an opinion that Concurrent Audit is desirable

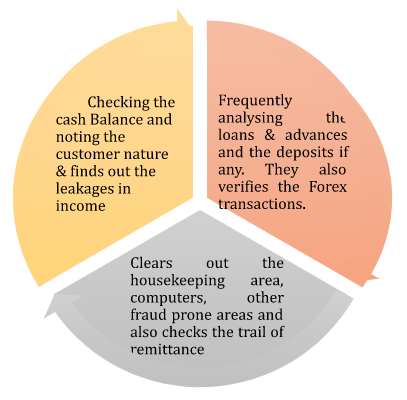

PROCEDURE