Internal Audit

Efficiency of internal controls, corporate governance and accounting processes can be ensured through this kind of audit and also help to maintain accurate and timely financial reporting and data collection. Internal audit can also help with risk management and safeguard against fraud, waste, or abuse. Internal audits may take place on a daily, weekly, monthly, or annual basis.

BENEFITS:

- A Proper accounting system is maintained

- Improves efficiency in the company’s the operations

- More Effective Management

- This will help improve staff efficiency and performance

- Ensures Optimum Use of Resources

- Asset protection is possible with internal audit

- It helps identify errors before the external audit

- Internal audits help investigate various aspects of the business properly

- The process of internal audit gives the organization a unique opportunity to conduct a review of the performances in the ongoing year itself

APPLICABILITY:

- In case of Listed Company: Mandatory for both private and Public Company

- In case of Public Unlisted Company: Internal Audit is mandatory if the,

- Turnover is more than or equal to Rs. 200 crore

- Borrowings is more than or equal to Rs.100 crore

- Paid up share Capital is Rs.50 crore or more,

- Deposits is equal to Rs. 25 crore or more.

- Private Unlisted Company: Internal audit is mandatory if Turnover is Rs. 200 crore or more and/or Borrowings is Rs.100 crore or more.

- For others, it’s not mandatory

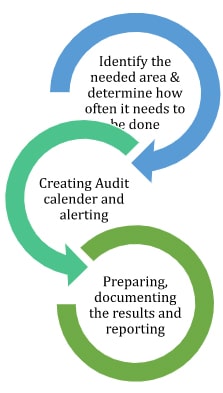

PROCEDURE: