Increase the rebate limit to Rs.7 lakh in the new tax regime. Thus,persons in the new tax regime, with income up to Rs 7 lakh will not have to pay any tax.

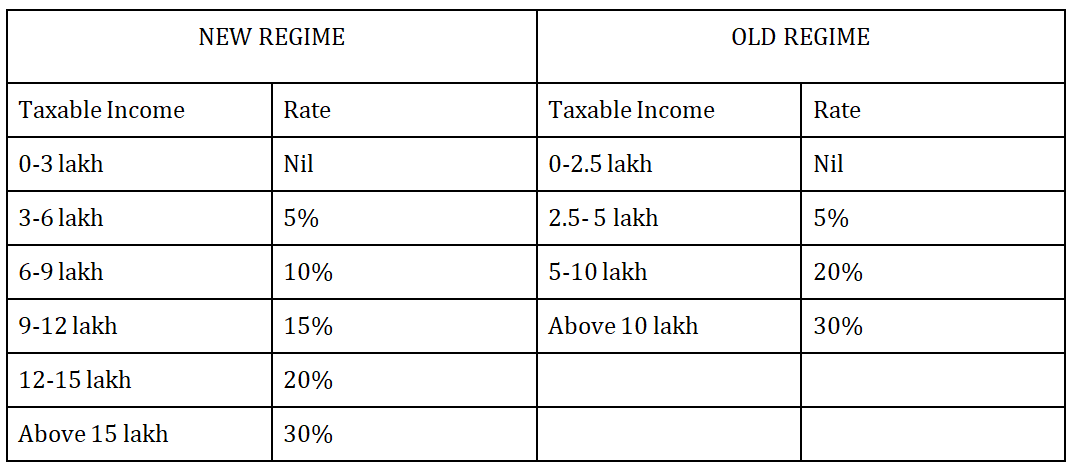

Propose to change the tax structure in this regime by reducing the number of slabs to five and increasing the tax exemption limit to Rs. 3 lakh. The new tax rates are:

The highest tax rate in our country is 42.74 per cent. This is among the highest in the world. Budget proposes to reduce the highest surcharge rate from 37 percent to 25 percent in the new tax regime. This would result in reduction of the maximum tax rate to 39 per cent.

TAX RELIEF UNDER NEW PERSONAL TAX REGIME

- The new tax regime for Individual and HUF, introduced by theFinance Act 2020, is now proposed to be the default regime.

- This regime would also become the default regime for AOP (other than co-operative), BOI and AJP.

- Any individual, HUF, AOP (other than co-operative), BOI or AJP not

willing to be taxed under this new regime can opt to be taxed under the old regime. For those people having income under the head “profit and gains of business or profession” and having opted for the old regime can revoke that option only once and after that they will continue to be taxed under the new regime. For those not having income under the head “profit and gains of business or profession”, options for the old regime may be exercised in each year.

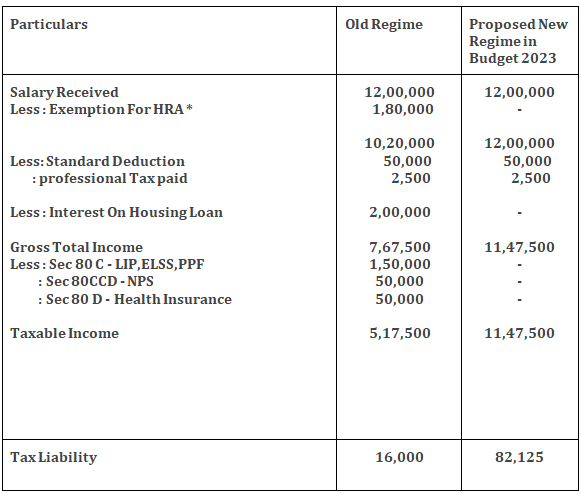

Do the new proposals seem to benefit everyone? Let’s check it with an examples

Illustration 1

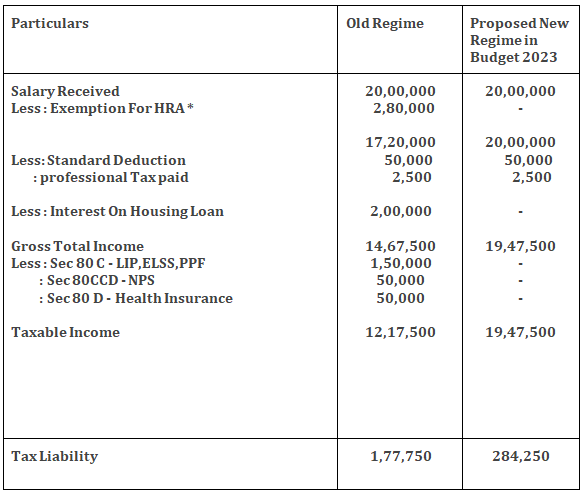

Illustration 2

Conclusion

If a person with an income of up to Rs. 20 Lakh has a proper income tax plan, it is better to opt for the old Regime.

Then the new proposed scheme is not good?

Of Course the new regime is good only for two types of people . First one is the person having income less than 7 lakhs and the second one is the person whose income exceeds 25 lakhs or you are not investing in any tax saving schemes and investing in higher return businesses .If your opportunity cost on such investment is lower than the amount of income from such investments