Startup India is an Indian government initiative. Indian Prime Minister Narendra Modi made the first public announcement of the campaign in his speech on August 15, 2015.

This initiative’s action plan focuses on three areas:

- Simplification and Handholding.

- Funding Support and Incentives.

- Industry-Academia Partnership and Incubation.

The scheme’s main objectives are to promote startups, create jobs, and increase wealth. This scheme has started a number of programs to transform India and build a strong ecosystem. The Department for Promotion of Industry and Internal Trade (DPIIT) is in charge of these programs. The scheme focuses on assisting SC/ST women entrepreneurs to obtain financing through loans. Women interested in pursuing careers in manufacturing, services, and trading can take advantage of the program. This program will help businesses that have at least 51 percent of their shares owned by SC/ST women entrepreneurs. 75% of the project’s total cost will be covered by the Start Up India loan program. On the other hand, the woman business owner will be required to contribute at least 10% of the project’s costs. The Startup India program has come up with a number of benefits, including ease of work, financial support, government tenders, networking opportunities, income tax benefits, and other benefits. This scheme will reach out to women through government and private banks. The Startup India program offers a number of advantages, such as ease of work, financial assistance, government contracts, networking opportunities, and benefits from income tax, etc.

Features of Start Up India Scheme

- Loan Amount

Loans for women entrepreneurs can range from Rs. 10 million to Rs. 1 crore. This could be employed as the new enterprise’s working capital.

- Debit Card Issue

The applicant is given a RuPay Debit card for the withdrawal of the deposited amount.

- Refinance Window

The Small Industries Development Bank of India (SIDBI) offers the refinance window with a starting loan amount of Rs. 10,000 crore.

- Composite Loan

The margin money for the composite loan will be up to 25% to help the credit system reach women entrepreneurs.

- Equipping Applicants

The applicants will be assisted in comprehending e-marketing, web-entrepreneurship, and other registration-related requirements via online platforms and other resources.

- Repayment Period

Applicants can repay the loan within 7 years. Every year a certain amount is to be paid as per the approved applicant’s choice.

- Security

Collateral security or a guarantee from the Credit Guarantee Fund Scheme for Stand Up Loans (CGFSIL) serves as the loan’s guarantee.

- Coverage :

The loan can be used to purchase vehicles for starting a transport/logistics company. Additionally, it could be used to purchase equipment for starting a construction or rental business. It could also be used to rent vehicles for taxi and car rental businesses. It could also be used as a term loan to buy office furniture or business equipment. The loan could be used to purchase office and medical supplies.

Benefits Of Startup India Scheme:

(i) Ease of Work:

Startup India hubs have been established by the government, where incorporation, registration, handling of complaints, etc., is simple to manage. The government has set up a simple registration process on the online portal, allowing you to sign up from any location at any time. The Insolvency and Bankruptcy Act of 2015 makes it easier for startups to wind up quickly, and a new startup can start within 90 days of the corporation.

(ii) Finance Support.

The government provides financial support to startups through the establishment of a collection of Rs. Rs. 10,000 crores for four years 2500 annually). The government makes investments in startups with these funds.

(iii) Government Support.

When it comes to large and expensive projects, a government tender is something that everyone wants. Under the Startup India Scheme, startups will have priority in obtaining easy government support, which is difficult to obtain. The good news is that no prior experience is required.

(iv) Networking Opportunities.

Individuals can meet a variety of startup stakeholders at a specific location and time through networking opportunities. It is made possible by the government by carrying out two startup tests each year, one on a domestic and one on an international scale. In addition, the Startup India program offers workshops and education on intellectual property.

Other Benefits:

- High Level of Responsibility.

- Day-to-Day Challenges.

- Learning Opportunities.

- Steep Learning Curve.

- Workplace Benefits.

- Less Supervision.

Benefits from DPIIT:

Companies that are registered under the DPIIT are eligible for the following benefits under the Startup India Scheme:

(i) Simplification & Holding

Startups gain access to a number of advantages, including simplified compliance, simplified exit procedures for unsuccessful startups, legitimate support, and a website that reduces information asymmetry.

(ii) Funding & Incentives

Startups will be exempt from Capital Gains Tax and Income Tax. Funds of funds to pervade more capital in the startup ecosystem

(iii) Incubation & Industry

Incubation creates numerous incubators and innovation labs, which is advantageous for startups. In essence, experienced institutions help startups grow their businesses in the market through incubators.

Benefits of Startups By the Indian Government

The Indian government has taken a number of steps to make the country more welcoming to startups over the past few years. Setting up shop in India can provide startups with the following advantages:

1. Access to a Large Market:

India is the world’s second-largest country, with over 1.3 billion people living there. Startups gain access to a large pool of potential clients as a result.

2. Low cost of setting up:

In comparison to other nations, India has a low cost of starting a business. This is because there is cheap labor and office space available.

3. Favorable Tax Policies:

Numerous tax incentives for new businesses have been enacted by the Indian government. These include tax incentives for the first year of operation and a profit deduction of up to 100 percent for the first three years.

4. Access to Government Funding:

Several funding programs for startups have been established by the Indian government. The Credit Guarantee Fund Scheme, the Venture Capital Fund Scheme, and the Seed Fund Scheme are examples of these.

5. Relaxed regulations:

Numerous startup regulations have been relaxed by the Indian government. These include expediting their approvals and exempting them from the requirement for a minimum capital investment.

6. Tax exemptions:

The government has provided startup tax exemptions under the Income Tax Act. This allows startups to save on taxes and reinvest their resources into their businesses.

7. Capital Gains Tax Exemptions:

Profits made from selling shares are exempt from capital gains tax for startups. Startups are encouraged to list their shares on stock exchanges and solicit public funding as a result of this.

8. Funding:

The government has established various funds to provide financial assistance to startups. These funds can be used by startups for business development and operations.

9. Mentorship and Incubation:

Through various initiatives, the government has provided startups with mentorship and support for incubation. Startups can benefit from this by having access to resources and advice from seasoned business owners.

10. Funding and Financial Assistance:

Through a variety of schemes and programs, the government provides startups with financial support and funding. This makes it easier for new businesses to get the resources they need to start and grow.

Startups may have a significant advantage over their rivals if they take advantage of these advantages.

Tax Exemptions

Entrepreneurs can benefit from startup programs by receiving a number of tax benefits. Those who operate private limited companies, limited liability partnerships, or partnership businesses may also be eligible for additional benefits, depending on the programs that are available to them.

- First three years

For the first three years, startups are exempt from all taxes, with the exception of the Minimum Alternate Tax (MAT), which will be applied to earnings based on 18.5% of the profit, as shown in the books.

Startups need to be registered with the Department of Industrial Policy and Promotion (DIPP) in order to be considered. This benefit is beneficial to startups because the cost of starting a business is a significant financial burden on entrepreneurs themselves. As a result, entrepreneurs will be able to balance their spending and break even sooner, resulting in higher profits in the long run.

A fund with an initial corpus of 2500 crores and a final corpus of 10,000 crores over four years is another benefit offered by the government to startups. This is covered by the Funds of Funds (FOF) benefit, which SEBI will direct as a direct investment and only applies to DIPP-registered startups.

This benefit comes as a welcome relief to many and will serve as a significant accelerator for the growth of such ventures, as financial insecurity is the most prominent issue that businesses face early on.

- Capital Gain Tax

When businesses share stock to raise money, the profits they make are referred to as capital gains and are subject to taxation. Because startups are exempt from paying tax on 20% of their capital gains, they are required to pay less tax on profits from the sale of stocks, bonds, and shares.

- Angel Investment Tax

Tax Investments are important sources of capital for entrepreneurs; however, when a business first starts, it may not be able to win the trust of investors and, as a result, may not be able to attract a large number of brokers and investors willing to spare their money.

Thus, business visionaries are left with no decision except for to move toward private supporters who haggle with the business visionary based on conditions in regards to intrigue and sum payable. In an effort to assist business owners in obtaining the capital they require, the government has eliminated angel broker investments tax-free.

Entrepreneurs now have the ability to issue shares at a rate higher than the book value thanks to an amendment to Section 56(2)(vii)(b) of the Income Tax Act, making it easier for them to raise money.

- Other Provisions

In addition to these tax breaks, the government has implemented a number of measures to support and assist entrepreneurs in the country. The following are a few of these:

- Up to 500 crores of rupees have been set aside to support women entrepreneurs and entrepreneurs from the Schedule Tribe and Scheduled Caste sects.

- Presumptive tax schemes for businesses whose turnover falls below 2 crores, whereas these schemes were previously available to businesses whose turnover fell below 1 crores.

- Reduction of long-term capital gains from three to two years.

- Amendment of the Motor Vehicle Act to encourage entrepreneurship.

- Provision from the Employee Provident Fund for the first three years.

Tax Exemption Under Section 80 IAC

As said earlier, startups are exempted from paying income tax for starting three years. Following are the criteria-

(i)The company should be recognised by DPIIT

(ii)Private Limited Companies and Limited Liability Partnership are eligible for tax exemption under Section 80 IAC

(iii)The startup must have established after 1st April 2016

Tax Exemption Under Section 56

Investments in eligible Startups listed with a Net worth of more than Rs. 100 crore or turnover above Rs. 250 crores will be exempted under Section 56(2) of the Income Tax Act. Investment in eligible startup by accredited investors, AIF’s (category I), and listed companies having a net worth of Rs. 100 crores or more than Rs. 250 crore will be exempted under Section 56(2) (VIIB) of the Income Tax Act

Eligibility for Startups Registration

- The company should form a private limited company or limited liability company

- The firm should get approval from the Department of Industrial Policy and Promotion

- The organization should have a recommendation letter by an incubation

- The company should have innovative products

- The company should be new but not older than ten years

- The turnover should not exceed over Rs. 100 crores

Who is eligible for Startup India?

-

- Age of the Applicant: Any Indian citizen aged 18 and Above

- Age of the Firm: The Date of Incorporation of the Company should not exceed 10 Years.

- Type of Company: The company should have been Incorporated as a partnership Firm, Private Limited Company or Limited Liability Partnership.

- Annual Turnover: The Annual Turnover of the Company should not exceed 100 Crores in any of the financial years since Incorporation.

- Original Entity: The promoters should have initially established the company or entity, not by dissolving or reorganizing an existing business.

- Innovative and Scalable: The Startup should have a plan for developing and improving a product or service and have a scalable model with high potential for creating wealth and employment.

Companies Working Towards developing a new product or service can avail of benefits under the startup India policy.

The conditions that they must fulfill are:

- Concerned startups must work to develop, Deploy or commercialise any product or service that is driven by the latest technology or intellectual property.

- Startups must aim to improve an existing product or create a new one to enhance customer value or workflow.

- Startups must only involve developing and commercializing a unique product to enrich customer value or increase workflow.

- Registration and approvals:

- Startups are required to obtain approval from the Department for Promotion of Industry and Internal Trade (DPIIT)

- Recommendation of an incubator from any post-graduation college

- Recommendation from an incubator from any post-graduation college

- Recommendation from an incubator recognized by Central Government

- A patent filed and published in the Journals of the Indian Patent Office in the specific area of product service.

- Registration and SEBI for startup-ups providing funding and equity services.

- Funding letter from the state government or central government of any scheme to promote innovation

- Partnership Share

For partnership startups, 51% of the shares should be owned by a woman or individuals belonging to the Scheduled Caste and Scheduled Tribe categories. They should not have defaulted on any credit payments

How to Apply Online for Startup India Scheme?

- Visit startupindia.gov.in

- Enter your company name, establishment and registration date

- Enter PAN details, address, Pincode and state

- Add the details of the authorized representative, directors and partners

- Upload the essential documents and self-certification

- File the establishment and registration certificate of the company

Documents Required for Start Up India Scheme

- Identity Proof (Passport, driving license, voters ID card, PAN Card, etc)

- Residence Proof (Voter’s ID card, passport, latest electricity and telephone bills, property tax Receipt, etc)

- Address proof for Business

- Partnership Deed of partners

- Photocopies of Lease deeds

- Rent agreement

- Passport size photographs

- Assets and liabilities statement of promoters and guarantors.

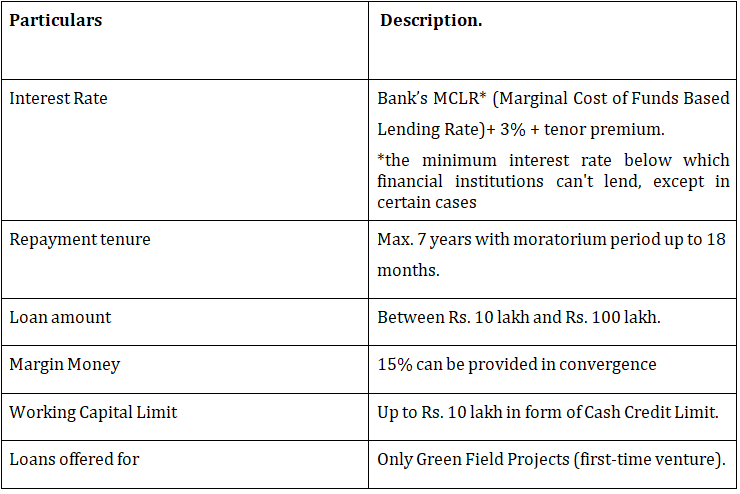

Start Up India Interest Rates & Scheme Details

The Start Up India scheme offers a great opportunity for women entrepreneurs. The interest rate is minimum and the repayment tenure is flexible.

Conclusion

Startup India is a good opportunity for the businesses who want to bloom in the market. This scheme gives you a lot of benefits and also saves you from Taxes. Start your own business with the help of Startup India scheme.

Indian government officials have realised that assisting entrepreneurs with their tax-related problems is the best way to encourage innovation. All of the aforementioned provisions enable business owners to take advantage of tax breaks, raise capital, and ultimately establish self-sustaining businesses.

Startups can gain a foothold in the competitive Indian market by receiving a number of benefits and incentives from the Indian government. Tax breaks, access to government funds, and preferential treatment in government procurement are among these advantages. The government’s focus on encouraging entrepreneurship and innovation can also help startups thrive by making the environment more conducive to their development.

Frequently Asked Questions:

Q1. Who cannot register a startup India Scheme?

A proprietorship or a Public Limited Company cannot be registered as a startup. A one person Company being a Private Limited Company is entitled to be recognized as a startup.

Q2.Can an existing entity register itself as a “Startup” on the Startup India Portal ?

Answer: Yes, an existing entity that meets the eligibility criteria can visit the startup India Portal and get itself recognised as a startup.

Q3.Can a Foreign Company register on www.startupindia.gov.in?

Answer: Any entity having at least one registered office in India is can register on www.startupindia.gov.in.

Q4.For how long would recognition as a “Startup” be valid?

Answer: An entity would cease to be a ‘startup’ upon expiry of:

- a) 5 years from the date of its incorporation/ registration, OR

- b) If its turnover for any of the financial years has exceeded INR 100 crore; OR Startups would be required to intimate DIPP of any such cases within a period of 21 days.

Q5.If an entity does not have a PAN. Would I be allowed to register my entity as a “Startup”?

Answer: Yes. An entity without a PAN can be registered as a Startup. However, it is advised that a valid PAN of the entity is provided at the time of registration, as each entity is a separately taxable person.

Q6.What is the objective of registration under DPIIT?

Answer: To reduce Regulatory burden on startups, thereby allowing them to focus on their core business and keep compliance cost low.

Q7.What are the Benefits and rewards of the registration under DPIIT?

Following are the benefits of getting recognised which will straight away uplifts the startups:

- First and foremost is the tax exemption which any recognised startup can claim.

- There will be a lot of income tax benefits for the period of three years.

- Save the money as well as time

- Investment exemptions can be availed.

- Concessions on all the capital gains can be availed.

- Fund by the government to help the startups.

- Self-certification and no inspection for three years

Q8.What are the documents and details required for filing the DPIIT application?

Answer:

- Copy of certificate of incorporation/ LLP Registration Certificate and pan card

- Brief details about company and products or services

- Brief profile of directors and authorised representatives such as email Id, contact details, and address etc.

- Detailed answers to the questions as prescribed at portal