The Direct Tax Vivad Se Vishwas Scheme, 2024, established through Chapter IV of the Finance (No. 2) Act, 2024, aims to simplify the resolution of ongoing income tax disputes. This initiative is intended to reduce litigation, improve timely revenue collection for the government, and provide taxpayers with clarity, reassurance, and savings on the time and resources typically consumed by lengthy legal battles.

Effective Date and Guidance

The scheme is effective from October 1, 2024, with detailed rules and forms published on September 20, 2024. In response to numerous queries from stakeholders the Board has released a Guidance Note under Section 97, which addresses common questions and aims to enhance understanding of the scheme’s benefits and procedures.

Eligibility Criteria

According to Section 89 of the DTVSV Scheme ,2024, the following categories of appellants are eligible:

- Pending Appeals: Individuals or entities with pending appeals, writ petitions, or special leave petitions as of July 22, 2024.

- DRP Objections: Persons who filed objections before the Dispute Resolution Panel (DRP) under Section 144C without a direction from the DRP by the specified date.

- Assessment Completion: Individuals in cases where the DRP has issued directions but the Assessing Officer has not finalized the assessment by July 22, 2024.

- Revision Applications: Those with pending revision applications under Section 264 as of July 22, 2024.

Non-Eligible Cases

Certain cases are excluded from the DTVSV Scheme as per Section 96, including:

- Tax liabilities from assessments under Sections 143(3) or 144 due to searches under Sections 132 or 132A.

- Cases with initiated prosecutions before filing a declaration.

- Tax liabilities related to undisclosed income or foreign assets.

- Assessments based on information from agreements under Sections 90 or 90A.

Additionally, cases subject to specific laws like COFEPOSA, UAPA, NDPS, and PMLA are also excluded.

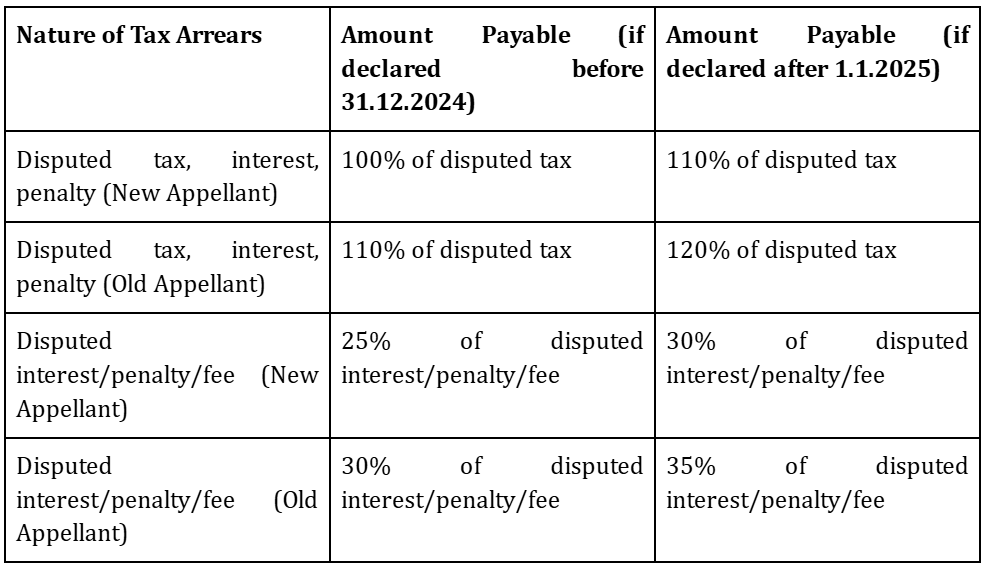

Payment Structure for Tax Arrears

The payable amounts under the DTVSV Scheme depend on the nature of tax arrears and the timing of the declaration:

Required Forms for the Scheme

Four forms are designated for the DTVSV Scheme:

- Form-1: For filing a declaration and undertaking.

- Form-2: For the certificate issued by the Designated Authority.

- Form-3: Used for the intimation of payment by the declarant.

- Form-4: The order confirming the settlement of tax arrears by the Designated Authority.

Important Filing Guidelines

- Multiple Disputes: A separate Form-1 must be filed for each dispute. If both the taxpayer and the income-tax authority have appeals regarding the same order, only one Form-1 is needed.

- Payment Notification: Payment details should be communicated in Form-3, along with proof of withdrawal of related appeals.

Key Timelines

- Filing Declaration: Taxpayers must submit Form-1 by December 31, 2024 to avail of reduced payment amounts.

- Form-2 Issuance: The Designated Authority will issue Form-2 within 15 days of receiving the declaration.

- Payment Deadline: Taxpayers must pay the determined amount within 15 days of receiving Form-2 and provide payment details in Form-3.

- Order Confirmation: After receiving Form-3, the Designated Authority will issue Form-4, confirming the settlement.

Clarifications on Eligibility and Assessments

Search Assessments

Assessments under Sections 153A or 153C related to searches under Sections 132 or 132A are not eligible. Similar exclusions apply to assessments under Sections 143(3) linked to searches after April 1, 2021.

Rollback Years and Advance Pricing Agreements

Taxpayers can settle disputes for selected rollback years while pursuing an Advance Pricing Agreement for other years, subject to certain conditions.

Appeal Status

Taxpayers whose appeals are pending as of July 22, 2024, but were resolved before filing a declaration, are typically ineligible for the scheme.

Settling Penalty and Quantum Appeals

Taxpayers cannot settle penalty appeals if the associated quantum appeal concerning the same disputed tax is still open.

Additional Considerations

- Protective vs. Substantive Additions: Tax assessments may involve both types of additions, but only substantive additions are considered for dispute resolution under the scheme.

- Exclusions: The scheme does not cover disputes related to wealth tax, securities transaction tax, or commodity transaction tax.

Conclusion

The DTVSV Scheme 2024 presents an important opportunity for taxpayers to resolve disputes efficiently. Understanding the specific provisions regarding penalty appeals, the distinction between types of additions, and eligibility criteria is essential for making informed decisions. For tailored assistance, consulting a tax professional is recommended to navigate this complex landscape effectively.